That means you, who’s looking forward to getting a tax refund on April 15. It might not be the dumbest thing you can do with your money, but it’s in the top 8.

Congratulations, getting that check means you let the government (definitely federal, probably state) enjoy your money all year long, as your employer dutifully paid the IRS every two weeks before you got your share. Of what you earned.

Remember that packet of papers the HR wench gave you when you started your current job? They included IRS Form W-4, which orders your employer to withhold some minimum amount of income tax from your paycheck. The implicit message from the government is you’re too stupid to budget, Citizen.

(You also can’t handle saving for retirement, and we don’t want you making too many decisions about your health care either. But those are issues for future posts.)

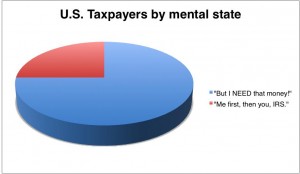

Many people, 75% of you according to some estimates, gladly choose to have their employers withhold more than enough to cover their taxes from each paycheck, thinking of this as “forced saving” in a gross misinterpretation of the term. The logic goes that rather than come up short on April 15, you can spend the whole year not thinking twice about your eventual tax bill. Best of all, when all those other suckers are lining up at the post office on Tax Day, not only will you not have to, you’ll be “receiving” money from the IRS. You outsmarted the system!

You didn’t.

You don’t want to get a big check from the IRS on April 15. You want to incorporate as a business, and send the IRS small checks on April 15, July 15, October 15 and January 15.

If you’re not an entrepreneur – i.e., if most of your income is still tabulated on W-2 forms rather than 1099 forms – you still don’t want to get a big check from the IRS on April 15. If anything, you want to cut them as big a check as possible.

“As big as possible” meaning not that you should give them all your money minus your living expenses, but as much of your tax bill as you can save until the last possible moment.

Look at it this way. Lots of merchants give cash discounts. The auto repair shop would rather have your money immediately than wait until the end of the month to receive it from MasterCard (after they subtract their cut, of course.) Continuing in that vein, the longer the merchant has to wait for your money, the more they expect. That’s why most invoices call for increased payments after 30, 60, 90 or 120 days, which is obvious.

The IRS has the second part of that down, being only too happy to assess penalties if you’re late.

So does that mean the IRS reduces your tax bill if you pay early?

(Sorry, broke a blood vessel from laughing too hard.)

If there’s no benefit to paying early, why on earth would you do it? Let the time value of money do its work. The longer you can hold on to it, the better it is for you.

Retailers use the annual ritual of receiving a check as a seasonal mating call. Come to our car lot, and we’ll double your IRS refund on the purchase of a new Camry! Turn your refund into a plasma screen!

A million years of human evolution, and our brains still haven’t developed to the point where they can instinctively appreciate the wisdom of deferring things beyond the obvious benefit.

Get the minimum deducted from each biweekly paycheck. (You don’t have to wait until the anniversary of your hire date. You can do this at work today if you want.) Take the difference between that and what you would have had deducted otherwise, and invest it in your 401(k). When it comes time to pay your taxes you’ll have enough to buy that plasma screen or Costa Rican vacation and then some.

If you’re not convinced by this point, then you have no willpower and will have to wait until we release a book called Let Someone Else Control Your Cash. Even worse, in the last few months we’ve seen just how hollow the phrase “full faith and credit of the (United States) government” goes.

For instance, the state of Hawai’i recently announced it was delaying its tax refunds until July 1. This isn’t to commemorate Canadian independence day, we’re guessing.

UPDATE: It isn’t. Make that August. Late August.

That leaves 49 solvent states. Well, except for Virginia. Oh, and Georgia, which kept its citizens waiting until mid-July and beyond last year. You knew New York would be a part of this too, right? How about Alabama? And North Carolina, you can step right up too. Etc.

States routinely budget in billions of dollars, making it easy to assume they have giant reservoirs of cash. They don’t. Californians pride themselves on having an economy that would be the world’s 8th largest were California a nation, but their state government doesn’t even temper the news when it announces it’ll be paying its creditors with IOUs.

America’s largest corporations by revenue are ExxonMobil, Wal-Mart, Chevron, ConocoPhillips, Ford and General Electric. Imagine what would happen if any of them decided to pay vendors or employees with postdated checks. Somewhere between the customer boycotts and class-action suits, the state attorneys general would be among the first to publicly call these companies out.

But remember, it’s businessmen who are evil.

Hmmm…if the state, or IRS, doesn’t owe you money (that was yours to begin with) in the first place, you’ve denied the taxing authority the chance to defraud you or make you wait.

Chances are pretty good that in the next year, your municipality will float a bond issue for more money for your neighborhood firemen. Or initiate a ¼% sales surtax. You’ll vote yes, probably because of the residual effects of 9/11. A few months later, when the firemen have spent all the money on lasagna and mustache grooming and matching blue shirts for their daily trips to the gym, try not to draw a correlation to your delayed tax return. Which you shouldn’t be getting anyway, if you learn how to Control Your Cash.

**This article was featured in the Truth or Dare Issue of Money Hackers Carnival #108**