Which is a bad idiom. Sending a piece of mail is a huge pain.

In addition to this particular clearinghouse of personal finance knowledge that you happen to have stumbled across, we also write for Investopedia, where the exposition is greater and the sexist vitriol scarcer than here. The folks there recently let us start recycling old posts, so here’s the very first one we wrote for them. This one was so groundbreaking, so elemental, so indicative of genius to come, that Forbes picked it up too. Best of all, it’s only slightly dated. Here, see if this opening paragraph doesn’t take you back to the days of AOL startup discs and music videos on MTV:

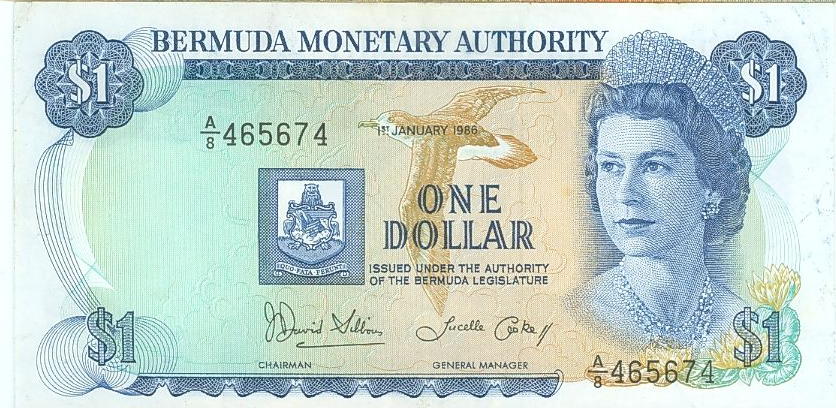

Even in today’s depressed housing market, you might have trouble scrounging up the $10 to buy a somewhat functioning house. (Pro tip: if you’re going to exchange one Alexander Hamilton for a house, put at least two bucks down so you can avoid having to pay private mortgage insurance. That could easily add another 18 cents to the price of the house.)

Try to ignore the grammatical error in the headline. The former editor inserted it.

We’ll do this every time we’re pressed for ideas. Enjoy.