A little public service announcement, if you will:

Visited a remote small town (pop. ~40,000) this week, parked in a hotel parking lot right off the interstate, and saw a kitten hiding in the bushes. Walked to the nearby supermarket, bought some cat food, and returned to see 4 of the kitten’s friends and/or siblings. And an adult cat.

An employee at the adjacent restaurant explained that no, no one dumped a litter of kittens in the parking lot, thank God. The colony of cats had been there for at least a year, ridding the area of mice and surviving off restaurant scraps. (Although they ate the supermarket food at superfeline speed.) In fact, the colony was now in its 3rd generation.

It’s only going to get worse, as this town has no volunteer organization to trap, neuter and release feral cats. The town also has extremely cold winters. Outdoors is no place for a kitty.

Don’t be cheap, negligent, or somehow moronically sympathetic to the idea of your pet losing his or her sexual identity. (Yes, some humans are that clueless.) Get your cat fixed. Or your dog. Or your child, if your child has traits that aren’t worth passing on to any descendants. If everyone did this, within a few years there’d be no more unwanted pets or unwanted stupid people.

Okay. Big Carnival this week, no time to spare. The Carnival of Wealth, weekly roundup of personal finance blog posts, etc., etc. Let’s go:

Dave at 6400 Personal Finance is so on-the-nose, every time he submits, that we figured we’d do him the courtesy of not making him have to scour the CoW to see his post.

If you’re jealous of those with more money, don’t just sit there and complain. Do something to make more money yourself – spend less time drinking or smoking and socialising, and more time working.

No, we’re not quoting ourselves. We wouldn’t use the Commonwealth spelling of “socialising”, although the rest of it sounds like something we’d say. Or Dave would say. Or anyone with even the most basic understanding of how to get rich would say. But because an billionairess said it, some people have chosen to be offended by it. So we can add “being indignant” between drinking and smoking on the list of things you should spend less time doing if you want more money.

Dividend Growth Investor explains why he thinks dividends are more important than capital gains. He says that stocks with consistently growing dividends free you from having to pay attention to market swings. We’d argue that that can’t be true, given that the price of a stock is a far greater component of its value than is its dividend, but he still explains his point in the staggering detail we’ve come to expect from him.

Off-Road Finance presents a lucid explanation of quantitative easing how the Federal Reserve is weakening our economy by incrementally lowering the value of each dollar as if by magic. God, this post is depressing. But necessary. Read it.

We think investing in real estate is one of the best ways imaginable to make money. It lets you leverage at a high level even if you’re a rank amateur, and both the real estate market and its secondary financing market are at historic nadirs. Free Money Finance thinks we’re crazy. Well, that’s not true. Then again, he might think we’re crazy, but if he does that assessment is irrespective of his submission.

His post is (partially) titled “Why You Should NOT Invest In Real Estate”. It’s really more of a reminder to anyone who thinks that there’s nothing more to it than buying a couple of houses and watching the money fall from the sky. This guest post written by someone named “Apex” is actually spot-on. You can make money in real estate, but it takes work and patience. (So do the smart thing, and buy lots and lots of lottery tickets instead!)

Our favorite new site logo of the week goes to the M.C. Escher-inspired use of negative space atop Financial Ramblings’ masthead. The author, Michael, just opened for business a week ago and so far has posted every single day, a schedule that will kill him. (Alas, he’s already repeating himself.) We loved part of his “About” page almost as much as we do his logo:

While many financial bloggers have built their sites on a foundation of personal struggles, I’m coming at things from a different angle. Yes, dramatic stories of debt and strife make for good reading, but I’ve always felt that you should seek out those who have tasted success and learn whatever you can from them.

He’s right except for one point. Stories of debt and strife make for horrible reading.

Our most shocking discovery of the week is that Paula Pant of Afford Anything (note the new absence of the hyphen, the story of which you can read about on her site) is a Burning Man attendee.

Dude, people don’t “attend” Burning Man. They participate.

Fine, Burning Man participant.

Actually, they prefer to be called “Burners”.

Sorry. We’ll consult our Hippie-English/English-Hippie dictionary next time. Bottom line, if you can temporarily get the image of Miss Pant riding a recumbent bike past a giant tin sculpture of a gyroscope while wearing a leopard-print bustier and matching grass skirt out of your head*, she left home for 10 days and the world didn’t end. It could have ended, but she delegated stuff instead. You should have such foresight. Her time was, and is, more important to her than money. Beyond a certain level, of course.

Sometimes we award a citation for the infomercial that does the best job of masquerading as a blog post. This week, John Frainee at Christian PF inspired a new category: infomercial that doesn’t even try to be anything but. See if you can figure out what he’s selling.

Has Harry Campbell at Your PF Pro stolen our idea of stealing stock photos? This week, he explains why you need to rebalance your portfolio and how often to do so. (Harry? Bigger font.)

A new and exceedingly verbose submitter this week is Billy Murphy of Forever Joble$$ (too-cute-by-half dollar signs his.) Billy is a professional poker player and a figurative poker player, too, examining the “pot odds” of various business opportunities while the people around him fold and complain about the cards they’ve been dealt. To the jealous (see Dave’s leadoff post above), Billy is rubbing your faces in it with his stories. To anyone who wants to build wealth – Control their Cash, if you will – Billy’s progress should be inspiring. Once he gets a proofreader, he’ll be unstoppable.

Dave at Excess Return explains dividend reinvestment plans. Just what they sound like, you use your dividends to automatically buy more of the stock that got you the dividends in the first place. The trade-off is obvious – it’ll cost you a little diversity – but Dave argues that with the right stock, this deferred-gratification strategy is well worth it.

Ken Faulkenberry at AAAMP Blog returns with his 5 largest factors that help your portfolio grow. #1 through #4 might sound obvious, but he explains their relative merits. Also, #5 is one that most people overlook.

From Andrew at 101 Centavos, all about algae! The fantastic new ecologically friendly fuel that will commit petroleum and its distillates to the ash heap of history, right next to the charcoal.

Yeah, except algae is inefficient as a fuel and requires inputs that aren’t readily available. Also, no private company will bankroll it, at least not without government subsidies. That’s why not 1 but 2 federal cabinet departments (Agriculture and Energy) are propping up the algae industry. And you thought we had an economic system that approximated free enterprise. Please. That died with Calvin Coolidge.

Cameron Daniels at DQYDJ.net pokes fun at all the “personal finance” bloggers who do nothing but post regular updates on their student loan and credit card balances. His lambasting is reprehensible, and we won’t stand for it. Those poor people are just trying to make it, they’re supremely qualified and very intelligent, they just got in a little bit of trouble and shouldn’t have to spend decades being punished for it, to say nothing of being ridiculed on top of that, and…we probably should stop, otherwise we’ll scare any new Control Your Cash readers into thinking that we’re being anything but sarcastic. Anyhow, Cameron’s post is hilarious and the comment section even degenerates into a discussion about home construction techniques (including one thread from a woman who claims that not only are European houses constructed better than North American ones, but that her sister’s North American house collapsed 3 weeks after she bought it. We’re not sure which is the more fanciful tale.)

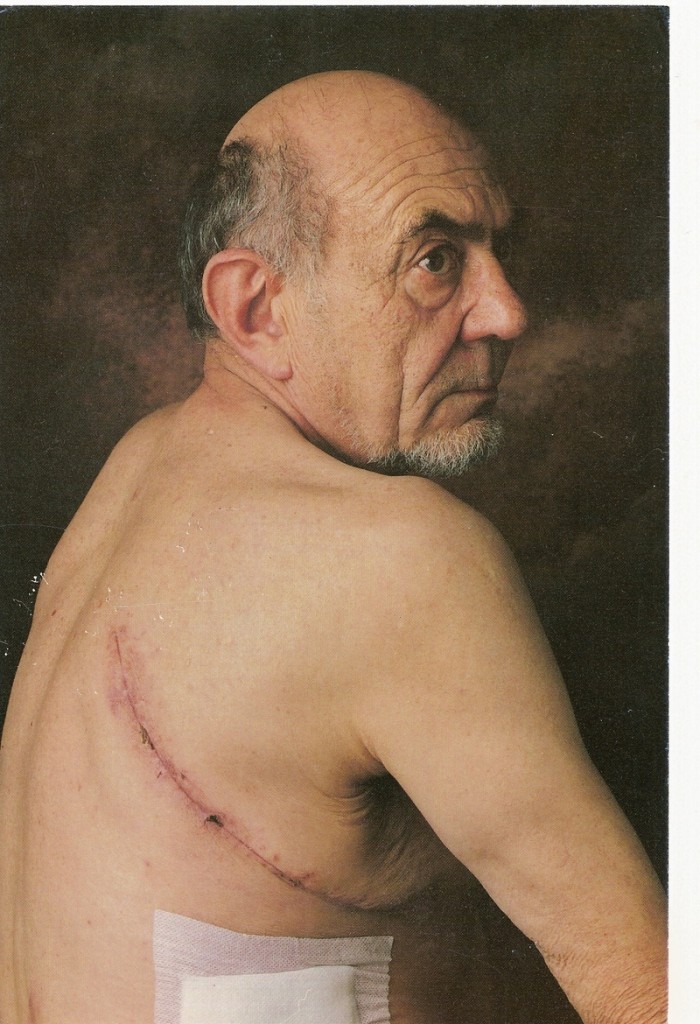

John Kiernan at Wallet Hub asks another of his depressing rhetorical questions to which the answer is usually “yes” followed by a sigh. Are We On The Verge Of Another Mortgage Disaster? This week, John hits on reverse mortgages. They’re bought primarily by stupid old people who don’t understand what they’re getting into. If wisdom comes with age, why are seniors always the ones getting taken advantage of by everyone from panhandlers to phishers to reverse mortgage salespeople?

Odysseas Papadimitriou at Wallet Blog (distant relation) discusses the impact food poisoning cases can have on the greater economy. But our takeaway line is his offhand comment that 240 people have been murdered in Chicago this year. On a completely unrelated note, Illinois is now the only state in the Union whose interpretation of the 2nd Amendment forbids citizens from defending themselves by carrying concealed weapons. A coincidence, we’re sure. Chicago itself has gun laws even more stringent than its state’s. Meanwhile, violent crime remains comparatively negligible in the parts of the country where people own the most guns (Alaska, Montana, Idaho, rural Nevada, the Dakotas, Utah, etc.) Another coincidence, doubtless.

If you’re worried about China soon having the largest economy in the world, what you’re saying is, “I’m an imbecile, and it never occurred to me that a country with quadruple the United States’ population should have a larger economy. Why, if that happens the average American will only be 4 times as rich as the average Chinese. How awful for us.” Liana Arnold at Card Hub (another distant relation) shows how with a burgeoning economy, the Chinese are also taking on our habit of overextension. BONUS: a picture of an actual Chinese person!

(The casual observer might think it’s a picture of Ms. Arnold. Actually it’s of the professor quoted in the post.)

Liana’s post contains one of our favorite lines, ever:

In China, you face criminal prosecution if you don’t square debts within three months of receiving your second past-due notification letter.

Please God, let that law be adopted in America. A side benefit to it would be the elimination of 99% of the blogs that Cameron at DQYDJ references above.

FICA! That mysterious acronym that appears on your every pay stub, by which the federal government confiscates your money before you even see it. You pay for Medicare, whether you’ll ever need it or not, and you pay for Social Security, even though it won’t exist by the time you’re old enough to qualify for it. (The road will end well before the can can be kicked that far.) That’s called living in a free society, if by “free” you mean “forcing you at gunpoint to contribute to the financial well-being of strangers, maybe even antagonists.”

Yes, that’s a diatribe but it’s going somewhere. Darwin’s Money speculates as to what FICA limits will be in the next couple of years: what percentage of your pay will go to fund FICA’s two components, and at what income level you’ll no longer have to pay additional Social Security taxes.

(And if you didn’t know, the Social Security tax is a regressive one. The more money you make, the lower the percentage of it you pay in Social Security taxes. Sound unfair? You don’t know the half of it. Read our book for the excruciating details, in the chapter that comes before the one about how to free yourself of this paycheck-to-paycheck nonsense once and for all.)

Glad you could make it. New content daily, new CoW weekly (hence its name), appearances on Investopedia irregularly. See ya.

*That’s what guys do at Burning Man, right? It’s probably safe to assume women do it too.