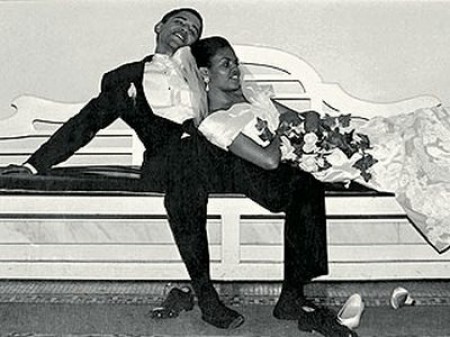

This picture was taken in 1992, right when the loan balances were at their highest. No word on how much the wedding cost, or if the betrothed paid for it out-of-pocket.

We’ve got a fantastic investment idea for you, one that you’re a fool if you don’t take advantage of. It’s a no-brainer, really. Refusing this investment would be like turning down matching funds from your employer for your 401(k). In fact, it’s even more fundamental than that. Refusing this investment would be like turning down a raise. “Do you want more money?” “No, I’m good with less, thanks.” Saying no to this investment would be like simultaneously spitting on the flag and tearing up a Bible. (Note: On the first draft that showed up on the page as “tearing up a Buble”, which would be awesome. Thank you, Mr. Qwerty, for putting the “I” and the “U” keys next to each other and making such comedy possible.)

And if you need more incentive, the President himself does it.

The investment? Student loans! Yes, they come with a mandatory interest payment, but who cares? Investment! In your future! (As if you could have an investment in your past or your present.) Keep repeating buzzwords as necessary!

If you needed any further proof that our economy is doomed and that you should save yourself and your loved ones first, read this quote from the chief executive himself:

We only finished paying off our student loans off about 8 years ago. That wasn’t that long ago. And that wasn’t easy–especially because when we had Malia and Sasha, we’re supposed to be saving up for their college educations, and we’re still paying off our college educations.

To recap: the President of the United States has a B.A. (from Columbia, which is not inexpensive) and a law degree (Harvard, which is less so). He started attending Occidental College in 1979 before transferring, and received the law degree in 1991. He financed at least one of the degrees, and paid back the loans in 2004.

So it took him somewhere between 13 and 25 years to pay off his education. Let’s split the difference and call it 19.

Also, while paying off the loans, he and his wife decided it’d be a good idea to take on more expenses – in the form of a couple of children. Those children, by the way, now attend an elementary/middle school that costs them a combined $64,920 to attend every year (includes hot lunch).

Let’s take the last part of that quote again:

We’re supposed to be saving up for their college educations, and we’re still paying off our college educations.

“We’re supposed to be saving up for their college educations”, as if it’s a moral imperative on a par with “we’re supposed to feed and clothe them.” No one even questions the value of this anymore: going to college is at least as important as anything else you can think of.

The above quotes come from a speech to, appropriately enough, a bunch of college kids (at the University of North Carolina); none of whom spent the previous weekend passing around the bong and sleeping through lectures. President Obama didn’t get into the financial details of his and the First Lady’s loans, but we do know that they took somewhere around 2 decades to pay off.

But that’s OK, because a college degree enables you to earn more money, right? It should be obvious that whatever increase in salary these borrowers enjoyed because of their educational status, it was more than negated by the price of the loan. 19 years is practically half a regular working life, and it’s being spent committed to paying down the debt incurred to ostensibly enrich that life in the first place. How much further could we take this? Would it be OK to work for 42 years, and spend 41 years paying off student loans? Why not? Investment (in your future)!

Some of you wags are bringing up objections. We can hear them already. Let the debunking begin:

1) “He was a law professor. An intellectual. The smartest man alive, in fact. What was he supposed to do, drive a truck?”

So by virtue of being smarter than someone who began working sooner and accumulated no debt in the process, the smart person…incurs obligations that take 2 decades to pay off? Fine, you lead 1-0.

2) “Well, he ended up as President. Therefore incurring student loan debt was the right move.”

By that logic, you can defend everything he did before the 2008 election. Snorting coke while organizing the community? +1. Attending a church presided over by a lunatic preacher with insane opinions? Another +1. Kids, put down the shovel and instead pick up the mirror and the straw. Then join the Westboro Baptist Church. Ticket to success, right there.

Finally, for fairness and balance, let’s include another quote about tertiary education from another man running for president:

When I went to school, we didn’t have a federal student loan program, and I was able to work my way through college and medical school because it wasn’t so expensive.

Never mind. Those are clearly the ramblings of a crazy person.

Seriously, why was college so much cheaper when Ron Paul was studying?

1. College hadn’t been rammed down our throats as mandatory. It was perfectly acceptable to brag that you were going to learn a trade after high school.

2. The government wasn’t involved.