Apparently, keno players are not as dumb as it gets.

This week, Refund Anticipation Loans. This is almost the invention of the wheel in reverse. Human ingenuity has now developed an inefficient, costly, inelegant, labor-increasing device that if left unchecked will send the species back millennia.

The “refund” in an RAL refers to a tax refund. You file your taxes with a professional preparer such as H&R Block. (Because addition is hard, subtraction is extra hard, and multiplication and division should be left only to the professionals, or at least to people who know how to press buttons on a calculator.) Then, because you overpaid your taxes throughout the year by having as much as possible withheld from your paychecks, the IRS returns to you the interest-free loan you gave it. Which can take weeks beyond the time you’ve already granted the IRS.

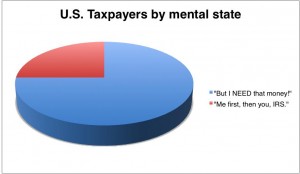

But this is America. We don’t do delayed gratification.

It bears repeating to the next social engineer who decries the amorphous “gap between rich and poor” that plagues our society: the poor are poor largely because they choose to be.

For those who can’t wait (and wouldn’t have had to wait, had they had the minimum deducted from each paycheck throughout the year), some enterprising souls created the RAL. Say you go down to the Jackson Hewitt office with your W-2s in tow. The preparer calculates that the money you’ve been lending to the federal government, without interest, totals $1000. Are you going to wait until April, maybe May, for that money when there are PlayStations to buy and child support to pay? Hell no!

So the preparer asks “Will you take $970 now?” And apparently, every year 12 million people say yes. If it’s any encouragement, a goodly ratio of them are probably too dumb to fill out a voter registration form.

If someone’s holding your daughter for $970 ransom with a 12-hour deadline before he mails you her scalp, only then is an RAL an outstanding investment.

That’s a 3% commission, for saving the taxpayer the trouble of waiting maybe a month for his refund. Which is an annualized rate of 43%, not that anyone ever waits an entire year. Still, that annualized number looks so enormous that it got the attention of some elected officials. Who decided that when two parties sign an agreement that showcases the stupidity of one party, the other party must be to blame. California’s attorney general sued H&R Block for offering RALs, an Illinois judge decided a $360 million settlement wasn’t enough, and the FDIC, America’s bank regulator, asked Republic Bank of Louisville to “consider ending (the) line of business” that represents most of its profit.

65% of people who receive Refund Anticipation Loans are already receiving the federal Earned Income Tax Credit. They’re so poor that they’re not making enough to be net taxpayers in the first place.

Someone found a racial component to this, too. In 2006, 7% of Illinoisans used RALs, but 23% of black Illinoisans did. If you’re black and use an RAL, then no, you’re not being exploited. But you are a moron. You’re equally stupid if you’re white, Oriental, or Melanesian and use an RAL.

Let’s hear from a loquacious consumer advocate on the issue:

“Almost one in four taxpayers living in African-American communities pays hundreds of dollars to receive his own money a few days early,” said Katie Buitrago, Policy and Communications Associate at Woodstock Institute. “Millions of dollars that could be used to pay down debt or provide a safety net for emergency expenses are being lost.”

No, that’s millions of dollars that could be used to buy crack, drink malt liquor, and spend on custom LeBron Air Max VIIs. Does Ms. Buitrago really think that RAL users are going to buy corporate bonds and index fund shares with their refunds? If they’re the kind of people who are farsighted enough to invest their money, they would have done it by now. Does she think refund anticipation lenders should just let taxpayers enjoy early money interest-free? Why should a tax preparation service that sells RALs be held to a higher standard than the IRS, which these taxpayers are giving their money to in the first place? (Then again, from the perspective of a taxpayer who’s let the IRS enjoy his money interest-free, it does make sense.)

Despite the extraneity of the second half of the quote, Ms. Buitrago is technically right. And practically disingenuous. Or just dense – it’s hard to tell with academics sometimes.

Again this has nothing to do with money, but assume that anyone who’s using the passive voice is hiding something. The quote should read “(People who are getting these RALs) choose to forgo millions of dollars that could…etc.”

Exploitation is an easy thing to prove. If you’re being taken advantage of without understanding the circumstances, you’re being exploited. When someone picks your pocket, literally picks it, that’s exploitation. When you sign an agreement granting someone the exclusive right to remove your wallet from your pants and take whatever they deem fair, you’re not being exploited.

Paying extra to get what was yours in the first place is called extortion, but even that isn’t accurate because most extortionists don’t operate with the explicit permission of the people they’re extorting money from. Furthermore, this subject matter is so outrageous that it’s reduced the author to overuse of italics.

Do we have to do this again? Here it is, in handy list form:

- Get as little as possible withheld from your paychecks. This will involve redoing your W-4, with the help of whoever handles this at your workplace. It should take less than a minute.

- You’ll now have more take-home pay in each check. Take the difference and invest it somewhere (NB: exacta boxes at the dog track are not an investment. Toyota stock is.)

- Write the United States Treasury a check at 11:59 p.m. on April 15.

It’s your money until the last possible second. You don’t pay upfront for most other things, why do so with your taxes?

If you’ve ever received a RAL, get the person who’s reading this to you to stop and smack you, but hard. The Marlboro reds, lottery tickets and 24-packs of Pabst Blue Ribbon will still be there when your refund check comes. So will the UFC clothing and Shadows Fall albums.