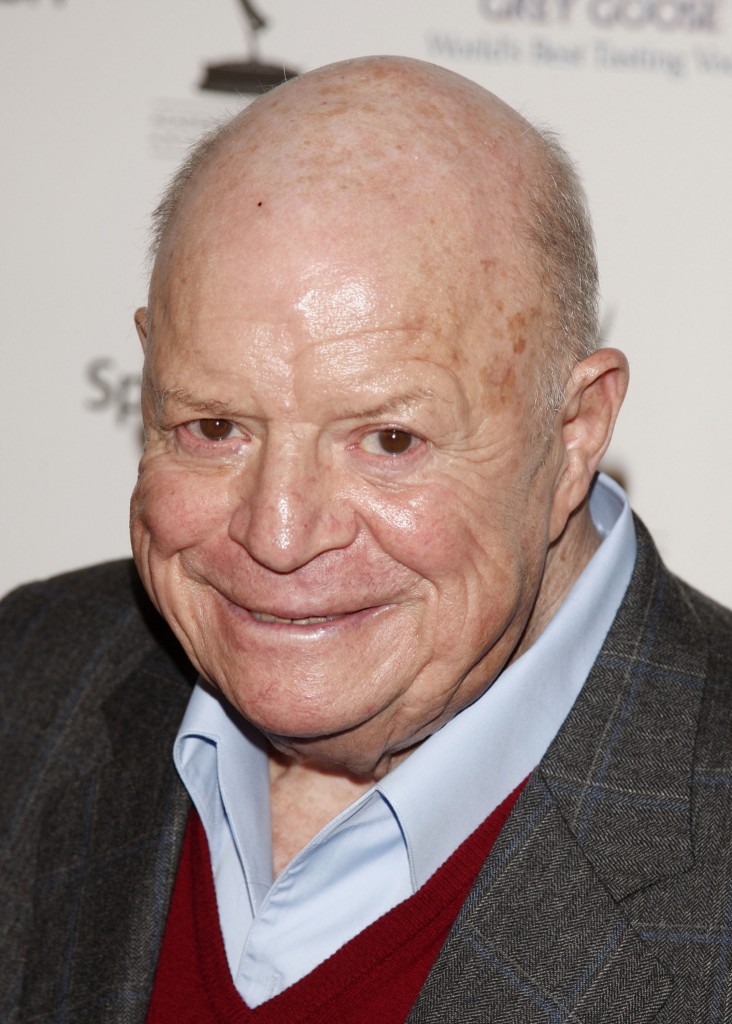

It took us decades to realize what a genius this man is. The nonpareil insult comic of all time, still bringing it at 87. Check out his Twitter feed: he comes from a different era, one when people could spell and punctuate. Also, when they could exchange affronts without anyone placing a call to the Diversity Promulgation Bureau of the local police department and throwing the offender in lockup for thoughtcrime.

Why are we honoring Don Rickles in this week’s edition? Because like many of his fans, some of our submitters want to get in on the masochistic fun. It’s a hoot to be the target singled out by Mr. Rickles, and Girl Meets Debt must feel the same way about us. Otherwise she wouldn’t have submitted 7 months ago and taken a verbal grenade to the thorax. Our takedown of her back then is too long to run in its entirety, but here’s an excerpt:

God, what a fecal stain of a post. It’s not the insipidity of it that bothers us, so much as how stinkingly tiresome it is. Who goes to the trouble of writing that post, or creating that blog, without stopping to think “Maybe this has been done before”? Fortunately though, the author equipped her post with icons that’ll let you share it with all your friends on Pinterest, Shareaholic, Tumblr et al. That the author thinks that between now and the end of the universe a solitary soul will share this post on Tumblr shows the kind of winning naïveté we’ve come to expect from our dippier contributors.

We don’t know about you, but that’s the kind of constructive criticism that would propel us to resubmit. Which she did, 2 weeks ago. Or as we said back then,

As we’ve said before–and unfortunately, we’re forced to repeat ourselves often–as a rule any blog with “Debt” in the title is going to be awful. […] We’re trying to entertain our readers and maybe teach y’all something, not bore you into unconsciousness with an indiscriminate series of links. So, [we’re] putting as much effort into our synopsis of Girl Meets Debt’s submission as she put into the submission itself [.]

Our intrepid heroine came back yet again, thus we really have no choice but to give her what she wants. Hell, we goofed on this character 7 weeks in a row before he finally deigned to pay attention, so maybe Ms. Meets Debt will eventually figure it out.

If you read our archives, or even stumble across an article at random, you’ll see our palpable disdain for debt bloggers. Anyone who’s ever started a blog with the intention of tracking her (or occasionally, his) debt is what we here at CYC like to refer to colloquially as a…what’s the word? Oh yeah. Loser. There are hundreds of them, and they’re as indistinguishable as blades of grass. Blades of languid, underachieving grass. Every last one carries student loan debt, student loan debt that went to finance a humanities degree. We can guarantee there’ll be credit card debt too. More often than not, there’s a weight problem as well. And a reluctance to use one’s photograph, or at least one’s full-body photograph. If there’s a significant other, it’s usually a “hubby” (their word) who’s discussed in varying stages of emasculation. Tying it all together will be a shocking lack of self-awareness, illustrated by such maneuvers as creating an emergency fund while the credit card and student loan debts continue to amass interest. These people aren’t interested in improving anyone’s finances (except for the folks at Sallie Mae and VISA), they’re interested in having their egos stroked by a comparably stupid readership. What makes Girl Meets Debt different is nothing, but if we had to pick something we’d choose her desire to be considered the archetype. Or as she herself sold this week’s post to us:

I envy people who naturally love to exercise and people who pay off their debt like a BOSS! I struggle like mad. But through trial and error I have found some tips that have helped me stay motivated to exercise and pay off debt. Today I’m sharing them.

So yeah, she’s fat in addition to carrying a negative net worth. We’re a personal finance site, not a health-and-fitness site, but we feel it’s our duty to explain to Ms. Girl Meets Debt that no one “naturally love[s] to exercise.” It’s a bitch. For at least the first 15 or so hours, lying in bed is always going to be more tempting than getting off one’s posterior and breaking a sweat. What motivates people to adopt the latter course, of course, is acknowledging that you can’t get in shape without doing uncomfortable, disruptive things to your body. By the same token, no one likes paying bills, and very few of us would go to work if we didn’t have to. But again, the long-term goal: It’s more fun to have food and shelter than to give into temptation and ignore one’s responsibilities. Ms. Girl Meets Debt just discovered this universal truth (about time, seeing as she went into hock to earn 2 degrees) and thinks it’s worth sharing.

For years, I thought exercise meant just going to the gym (which is actually very boring) or playing sports which isn’t really my thing but there’s so much more out there! I’ve recently discovered that I enjoy hiking and biking! Apparently, nature rocks my socks! I’m also interested in trying out yoga or jazzericse [sic] but waiting for an opportunity to try it out free first before committing.

Speak for yourself, sister. Going to the gym is like a BASE jump compared to reading your blog. Also, can you stop writing like an adolescent girl? A lifeless point of fact – e.g. that you can burn calories while neither visiting a gym nor playing an organized sport – doesn’t warrant an exclamation point.

Jazzercise? What are you, 60?

Regular readers, you may not comprehend that there’s a large sector of the blog-consuming population that finds such tidbits tasty. One woman proclaims her love for yoga – or in this case, her interest in possibly doing yoga at some point if she can scrape together $12 for a mat and a magazine – and other women pretend to care if it means pageviews for their own rotten blogs.

When I’m being extra ambitious I even walk up the escalators instead of passively standing!

And when some Navy sailors are being extra ambitious they apply to Basic Underwater Demolition/SEAL school, but to each her own. Wait, here comes the passive-aggressive shot at the “hubby”, or in this case a proto-hubby:

Sometimes I picture myself slim and wearing a beautiful white dress on my special day to keep me motivated…(J are you reading this?)

The emoticons came with the original, not that we need to remind you of that. Her post is actually a synthesis of both workout advice and personal finance advice. From the latter category:

Hearing success stories of people who have paid off their debt or people who are currently on the same debt-free journey I am on is such an inspiration for me. I use to feel so alone and ashamed of my massive debt but knowing that I am not the only Girl out there in this situation has been a huge kick in the butt for me to work hard and one day be a “success story” myself of someone who has paid off over $50K of debt on a modest salary.

She started losing grammatical rigor and veering off into inscrutability near the end there, but she’s right in that she’s certainly not hurting for companionship among the equally clueless, indebted, self-absorbed and dull.

I haven’t had many milestones yet, but when I hit below the $50K which I haven’t been in years, I was literally so excited I did a little dance!

Again, more power punches to the solar plexus of comprehensibility, and another exclamation point for good measure, not to mention a superfluous use of the word “literally” (which beats an incorrect use any day), but that quote gives us the chance to share some wisdom. Honey, we’re at the point where our (positive) wealth can increase in $50,000 increments. Which we don’t celebrate by doing a little dance (!) Because we haven’t really accomplished anything. You’ve accomplished even less. To paraphrase Chris Rock, “Oh, you got closer to zero. You started at zero. You’re supposed to be above zero, low-expectation-having motherf***er!”

When I feel a little debt fatigue coming on, I treat myself to something nice that won’t break the bank like a manicure/pedicure. Nothing is wrong with that and don’t feel like it is a deterrent to your debt-free journey.

1. Sister, you see that earlier blockquote? The one about how you “feel so alone and ashamed of my massive debt but knowing that I am not the only Girl out there in this situation has been a huge kick in the butt for me to work hard and one day be,” etc.? If you knew what commas were, that paragraph would have come closer to making sense.

Your fear of commas rendered the current blockquote unreadable, too. We assume you meant that a mani-pedi is an example of “something nice that won’t break the bank,” to quote an original saying; and not that your readers should avoid spending their scarce resources on services that will, as you wrote, “break the bank like a manicure/pedicure.”

2. Of course something is wrong with that, dingbat. It’s money that you’re giving to the Vietnamese lady at the salon, for an utter non-necessity, that you could have given to your creditors to reduce your debt a little more. Keep justifying, keep being poor, and keep ignoring the advice of the people who have been there, done that, and the positive net worth to prove it.* When you’re in the red, you don’t get mani-pedis. Or trips to Cancun. Or custom rims. You get nothing but thin gruel and Ross Dress For Less clothes until you’re in the black. If that sounds harsh, we’re not the ones who asked you to incur all this debt in the first place. Our way works. Yours doesn’t and never will. You’re an idiot. Stop submitting. Today’s post is already twice as long as the CoW of 3 weeks ago and we haven’t even gotten to a second submission yet.

[M]y greatest tip for both exercise and paying off debt is to start NOW. Not tomorrow, not after you watch an episode of Game of Thrones but NOW.

Or if not now, then after the mani-pedi and the search for a free yoga mat.

Can anything wash off the stink of that last submission? Let’s start with the 1-2 punch of color, counsel and attitude personified by Jason Hull and Sandi Martin, a couple of professionals whom we can feature in complimentary terms here week after week and no one’s going to think we’re being sarcastic. First Jason, he of Hull Financial Planning. Jason invokes the Efficient Market Hypothesis (short definition: The sum of all players’ knowledge is in the price of the security, or will be momentarily. You can’t arbitrage, or take advantage of price discrepancies, because there are no price discrepancies.)

The problem is that irrationality is common, and lasting. Gaining an asymmetrical edge? Kids, absorbing what’s on Yahoo! Finance does not create asymmetry. Anyone can read it. Barrick Gold’s insider dealings are plenty asymmetrical, however, and taking sensible advantage of them would thrust you up against society’s draconian privileged information laws. So what to do? Read Jason’s post, that’s what.

Now Sandi, the Bizarro-Girl Meets Debt, of Spring Personal Finance. Girl Meets Profit, if anything.

One of your CYC principals is an ex-Canadian, and used to take great pleasure in sharing fictional quirks of Canadian life with unfamiliar Americans. For instance:

- Canada has 2 types of stop sign. There’s the standard red octagon, but also the red octagon with a white border. That second type is optional: if there are no other cars at the intersection, you can proceed right through.

- The province of Quebec has an armed police unit whose job is to fine businesses whose signs are in English (Canada’s primary official language.) They’ll waive the fine if the sign is also in French, but the French sign has to be at least a certain ratio larger than the English sign. And yes, they carry rulers.

- In Canadian mutual funds, embedded commissions are illegal.

Alas, 1 of those is true and 1 is on its way to being true. As a fee-only financial planner herself, Sandi explains that the noble phrase “fee-only” can be distorted by the unscrupulous. Advisors at Canada’s 5 major banks may not take a cut of your investment, but they do get paid for hitting sales targets. And those advisors get more for selling actively managed portfolios than they do for selling simple money market instruments and mutual funds.

So blatantly taking a commission isn’t so bad. But if embedded commissions were to be eliminated, as some regulators are proposing, it’d hurt some honest financial planners. But it’d help true fee-only planners such as Sandi. Or planners could just disclose their fees, which would seem to benefit everyone. Sandi’s research cites the example of an investor who didn’t know that the funds his advisor bought came with huge and undisclosed expenses.

Speaking of financial advisors, and Canada, Big Cajun Man at Canajun Finances returns after a hiatus of God knows how many months. And features a guest post from…the very investor Sandi was citing. The investor stuck with his advisor, temporarily, even though their meetings were just one giant emergency beacon.

A new submitter, probably not Canadian although he looks it, is Bryce Fowler at Save & Conquer. Bryce recently returned after a 4½-year blogging hiatus. Lucky bastard. He said you shouldn’t borrow money to finance something unless it has the capacity to appreciate. Your grandmother’s porcelain doll collection is not going to appreciate. It will only cause intergenerational misery.

Unless you’re Derek Jeter (Hi, Captain!), your life is probably not as awesome as Paula Pant’s is. The Renaissance gal behind Afford Anything travels the world at her leisure. Latest stop, Paris. Paula figured out that being alive in 2013 means she can, as she puts it, “not so much ‘[vacation]’ as [live] my normal everyday life, with this new city as the backdrop.” Thousands more people could do this than actually do it, but then they remember that the cubicle farm is warm and safe. And it’s Monday, so there might be bagels.

Kristen at My Dollar Plan explains why you didn’t get a tax refund. You shouldn’t want one anyway, because getting one means you let the government enjoy your money interest-free all year long, but you definitely won’t get any quarter from the IRS if you’re bad at math. Which you probably are, which is why you’d otherwise be eligible for a refund in the first place.

(Groan) Here’s another new submitter, Christine at The Pursuit of Green. What makes Christine so interesting and distinctive? Let’s let her bio speak for itself:

I live in the crazy city of Los Angeles! I moved out here after college, started working, and found the love of my life! Who I recently just got married to! Yes we are newlyweds!

I also love to cook and to eat! Food is seriously one of the most wonderful things! It nourishes you, brings people together, and is so diverse!

That looks like fun. Mind if we try?

In this week’s post Christine explains what net worth is! Your assets minus your liabilities, in case you didn’t know! However, we here at CYC wrote a whole book about how the traditional definitions of “asset” and “liability” are so misleading that you could spend your life trying to maximize the former and minimize the latter while getting no further ahead! Christine writes like a 5-year-old who just discovered the Wikipedia entry for “Net worth”! She also has no comments nor Feedburner followers, and maybe that’s for a reason!

God, that was exhausting. Although she has a point, food is indeed one of the most wonderful things (!)

Bryce Heston at The Skilled Investor has a great URL and a site whose HTML hasn’t been updated since the Blaze Bayley years. (Long-suffering Iron Maiden fans nod their heads.) We’d tell you what this post was about but all we saw was fonts of varying sizes.

Bryan Chau at Success Pen Pal watched a movie. That’s pretty much the extent of that.

Finally, Lynn B. Johnson at Wallet Blog compares Roth IRAs to 529 college savings plans. If you absolutely insist on funding your kid’s future college tuition, knowing that it’s probably not going to pay off, Lynn explains which of the 2 vehicles listed above is better. More importantly, she gives a definitive answer instead of just listing pros and cons for both and not saying anything decisive.

God, that was exhausting (reprise.) Thanks for reading. See you next time.

*That sentence is dissonant, but it’s syntactically sound. Specifically its second half: “…the people who have been there, done that, and the positive net worth to prove it.” In other words, the people who have been there, who have done that, and who have the positive net worth to prove it. See? It makes perfect sense.