Let’s start with Gail Vaz-Oxlade of CNBC, who will separate you from $30 if you buy her “Til Debt Do Us Part Life Planner”.

Get it? It’s a pun. Here, we’ll walk you through it: she exchanged “debt” for “death”. It’s not quite as clever as “dollars and sense”, but it’ll have to do.

Why should you buy this?

52 brand new financial tips, variable expense tracking worksheets…and show challenges you can do at home!

Go in your car’s glove box, and look at the manufacturer’s maintenance schedule. It should be right next to the owner’s manual. The maintenance schedule includes a handy checklist of services you should get done to the car at certain intervals, complete with little boxes to fill in. Change oil and filter at 5,000 miles, replace Zerk fittings at 60,000 miles, etc.

How long have you owned your car? Okay, how many of those boxes have you filled in? And yet Gail Vaz-Oxlade thinks you’re going to get excited about “variable expense tracking worksheets.” Lady, if I spent $26,000 on a car and can’t be bothered to show my homework, you’re going to have to charge a lot more than $30 for your life planner.

Just read this nonsense:

Is there some rule that every letter S in a financial site’s name has to be mutated into a dollar sign?

- CONTROL YOUR CA$H

There! Are you happy now? No, wait. We can do better:

- ¢ONTROL YOUR ¢A$H

Come on, that’s money! Get it? Money! Unfortunately, the letter E doesn’t appear anywhere in the name of our site, or we could turn that into a euro sign. Alright, one more:

- ¢ONTROL ¥OUR ¢A$H

Back to Ms. Vaz-Oxlade. Is she out of her mind? Out of every 10 marriages, 9 of them break up because of money problems? Most personal finance “experts” wait until you’ve read a few pages before subjecting you to falsehoods, but Gail knows the importance of a killer opening sentence.

Oh, come on. What she meant was that 90% of all divorces are related to finances.

Then that’s what she should have said. This is someone who communicates for a living. Poorly. And even that statistic is pure fiction.

Here are a select few of her “10 Tips To Get Out of Debt”, and you can tell what a priority these tips are given that no one at CNBC bothered to remove the HTML tags:

Did you know that? You had no idea, did you? If you’re carrying credit card balances, you should remove the catalyst that enabled such balances, i.e. the cards themselves. Look for the next tip in Gail’s Anthology Of Obvious Advice: “You ran over your kid? Next time, consider making sure that there’s no one behind your Sienna before backing up.”

She didn’t say that, but she did say something equally pointless:

Jesus, Mary, Joseph, the animals in the manger, and all the saints and angels. CNBC has millions of viewers, and the threshold for being paid to talk to them on air is a pulse, a triple chin and an unwieldy last name.

“Hey Lurleen, Gail Vaz-Oxlade has a great idea for us to get out of debt.”

“Really, what is it?”

“She says we should bring in extra money.”

More specifically, she wants you to “consider overtime.”

This reminds us of a taxpayer-funded boondoggle in at least one state, and possibly in yours. Utah sponsors something called the Baby Your Baby program, which tells mothers how to raise their kids.

Using drugs (both legal and illegal) while you are pregnant puts your baby at BIOLOGICAL risk for future behavioral and developmental problems.

If you are pregnant or considering becoming pregnant, help prevent birth defects by NOT using alcohol, drugs or tobacco.

We can use triage here. There are exactly 3 classes of pregnant woman:

- Those who wouldn’t dream of smoking, drinking, or shooting up while pregnant.

- The kind who’d respond to the suggestion that they shouldn’t partake in unhealthy substances with “I’m a good mother, and f**k you you can’t tell me how to raise my baby!”

- Those who would smoke, drink, or do drugs while pregnant, but who will change their minds after being told that such activity might not be in the best interests of their babies.

We’d guess that 90% of mothers would fit in the first category, 10% in the second. Maybe the one’s a little higher and the other a little lower. But one thing is certain: there are zero mothers in Category 3. (And if any do exist, God help their kids.) No one will benefit from the suggestion not to poison oneself while pregnant, because women will either do so or they won’t.

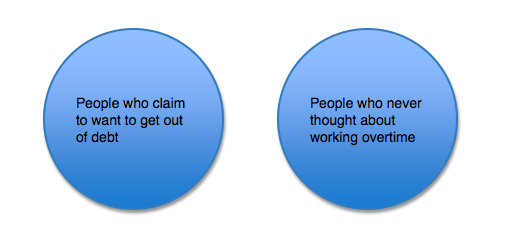

Same thing with Gail Vaz-Oxlade’s minions. Here’s a Venn diagram of her audience, represented by the intersection of the two sets:

The purpose of Gail Vaz-Oxlade’s useless life planner, and the purpose of her tips, and the purpose of the husky lady herself, is purely to take up space. The people who are in debt, yet who didn’t give working overtime a thought until Ms. Vaz-Oxlade brought it up, don’t exist. No one is stupid enough not to think of overtime, yet smart enough to realize he needs to get out of debt. The two categories don’t overlap on the continuum that has Chris Langan at one end and Mindy McCready Tyra Banks on the other. Here’s more garbage posing as wisdom:

Just like that, Gail Vaz-Oxlade’s advice moved from neutral to negative.

When working your way out of debt you can still spend on things that are important to you, you just need to plan and save for them.

NO. Should we use a bigger font to emphasize our point?

99% of personal finance advice is interchangeable, and 99% of it is false. Again, we at Control Your Cash are the 1-percenters.

Gail Vaz-Oxlade qualifies by writing “things that are important to you”, which should mean food and clothing, but we all know what she’s referring to. (The accompanying photo is a clue.) If you have a negative net worth, you don’t get a wedding. Well, maybe a $75 one at the Justice of the Peace, but with no reception and no honeymoon. Why not? Because you’re in debt. If you believe the axiom “You need money to make money”, which is a practical truth, it follows that debt – the inverse of money – is standing in the way of you making money. Saving for a wedding doesn’t make sense, because if you’re saving, you should be applying it to the debt – which carries interest and thus, left unchecked, leaves you in a bigger hole a month from now than you’re in today. Anyone who can’t see this is too retarded to own a computer. Wait, she’s not done:

“Discuss the day’s events and catch up.” Chance that a man wrote that: -60,000%. Maybe, just maybe, sitting down and having to face each other at the end of another negative-worth day is enough to put a couple among that 90% who get divorced. But no, an innocent $9 trip to El Pollo Loco will condemn you to an eternity in debt. Instead, you should have a $20,000 wedding! “You just need to plan and save for (it)”!

Stop believing the nonsense. We don’t have the platform of a fancy TV show with a wardrobe and makeup and everything – in fact, this post is being written pantslessly – but Gail Vaz-Oxlade’s advice borders on felonious. If you’re in debt, live like a Capuchin friar until you’re out of debt. If you eliminate tiny little purchases, e.g. lunch, while justifying gargantuan ones like weddings, you deserve to have what few assets you do possess taken away from you. And stop watching TV. Order our book instead.