A year ago, this woman was driving a cab and $40,000 in debt. Then she read our book. Now she sleeps on a bed of emeralds.

A special hello to viewers of The Balancing Act, and thanks for joining us here at Control Your Cash. Where several times a week, we explain how to build legitimate, lasting wealth for the long run – without driving yourself crazy in the short.

If you don’t know the first thing about where to spend, how to invest, how to negotiate (probably the most valuable skill you can learn in this life) or even where to begin, browse the archives. (Warning: it’s pretty comprehensive. You could spend days in there.)

You just described me perfectly: I have no idea where to begin. I know how to make deposits in a savings account, and write checks, but beyond that I’m mystified. Help.

Then start by buying our book, Control Your Cash: Making Money Make Sense. For at little as $7 on Amazon. The book starts off assuming you know nothing about personal finance, and by the time you get to the end, you’ll be able to:

-do your taxes without leaving thousands of dollars on the table

-buy a house or a car confident that you got the best possible deal

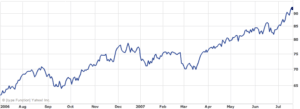

-know when it’s time to bail out of the market, and when it’s time to jump in

-have your credit cards work for you, instead of the bank that issued them.

Financial peace of mind. Believe it, it’s easier to have than you imagined.

One more, very important thing: we’re also the proud authors of the brand new e-book, The Unglamorous Secret to Riches. (Seriously, brand new as in “just released this month.”) Want to know how to create permanent and lasting wealth without relying on your job, your investment adviser, or your friendly neighborhood lottery ticket salesman? The Unglamorous Secret to Riches tells you how in simple, direct terms. (And don’t worry. It doesn’t require taking on a second job, selling all your possessions, nor trading in your car for a bus pass.)

And as a special bonus, for the next 24 hours only we’re making The Unglamorous Secret to Riches available exclusively to Lifetime viewers for just $3.50. Yes, the mythical price of a latte. (Only by spending that $3.50 here, it could pay for itself thousands of times over.)

(Addendum: That black $3.50 is the link to the e-book.)

Thanks again for coming by, and we hope to see you around regularly. (We’ll even make it easy for you: you can subscribe to our RSS feed just by clicking here.)

Also, don’t forget to follow us for regular daily tips on Twitter, and join our ever-growing army of friends at Facebook. And feel free to drop us a line anytime at Betty@ControlYourCash.com or Greg@ControlYourCash.com.