It’s Wednesday, which means it must be time for another guest post from the mysterious MD. (Check out his post from last week if you haven’t witnessed his genius yet.) Now read:

Dear CYC principals,

To the bewilderment of most Canadians I chat with on a daily basis, I like the U.S. enough to move to and call it home. Don’t get me wrong. The standard of living in Canada is great, it’s uniformly safe, and physician salaries are generally higher. For entirely non-financial reasons that differ from yours, I want to make the switch. The long winters just get to me, people are passionately indifferent about everything, and there’s a general lack of the sort of entrepreneurial spirit I sensed when I lived in the United States. Plus, I’m still bitter that Quebecers didn’t separate. At 5:00 most mornings, all I want to do is chew quietly and stare at an English-only cereal box. Is that too much to ask?

I will be building U.S. credit from scratch beginning July 1, 2013.

My (flawless) Canadian credit rating doesn’t directly transfer. Bummer. I was hoping to use it for leverage and become wealthy, like Paula Pant at Afford Anything does. The whole process is going to be a new venture. As outlined in a previous post, I’ll bring home close to the median U.S. household income for the next 3 years of residency.

That’s enough filler. I’ll cut to the chase.

I’ve been mulling over the idea for a while, but I needed to find the right capitalists. Confident that the principals of CYC are up to the task, I have an opportunity for your corporation:

Lend me $150,000 to transfer a portion of my medical school debt once I move to the U.S. for residency training.

Transferring a portion of my student loans to a U.S. lender is daunting. I don’t have the contacts to find alternative credit at comparable rates.

Most private U.S. lenders offer 7-9% and are surprised when I refuse and tell them they’re missing an opportunity. They probably don’t have a printed form titled “Financially Literate Young Doctor from Canada Applying for U.S. Credit Right Out of the Gate.” No one answering the 1-800 numbers understands what I’m asking for, because it’s unconventional. Credit unions are rumored to be the place to go if you want an “alternative approach,” but I’m sick of dealing with mid-level managers who don’t have any independent decision-making capacity within their organizations.

I’m offering you a chance to be that lender.

Here’s the plan: One year from my residency start date on July 1, 2013, I’m going to send you an e-mail.

I’ll include a listing of my earnings and expenditures for 1 year. I will have $5,000 in liquid assets, I will have a zero credit card balance (naturally), and I’ll include my monthly cash flows (including pay stubs) to prove that I can properly allocate resources and control my cash. I’ll be ashamed if I get a large income tax refund, because I don’t lend my money interest-free. Nor should any of your readers.

This is my financial situation as of March 2013:

Current assets:

M.D. Augmented by an uncommonly strong work ethic. Professional and personal references not required. They’ve been rendered unnecessary by a few pieces of paper. In this case, official copies of USMLE scores in comparison to the national mean, given a standard deviation. Medical school (and most things in life) requires far more hard work than raw mental horsepower. I’m not that smart. You read how long it took me to figure out that my student debt was leverage, and not a thing that goes “bump” in the night.

A car. I don’t count my car as an asset since it’s not directly involved in making me money. But that’s me. You don’t seem like the accounting type, but if you are, my wife owns a nondescript one. We share. Ask me sometime (for your readers’ benefit) why she’s the registered owner and listed as the primary driver.

An emergency fund. Just kidding. No one who actually understands money has one.

Current liabilities:

($37,380) in Canadian federal student loans. In case you thought your government cornered the market on giving away money beginning January 2008, our government does too. Thanks, Harper. The turtleneck sweaters you wear underneath blazers to meet international leaders really send the signal that Canadians should be taken seriously. Or is that a dickey?

($141,995.19) on a student line of credit with a $150,000 limit. This is what I’m looking to transfer.

($38,026.00) on another student line of credit.

Net worth:

($217,401.19)

Alternatively, you’ll see the investment opportunity right now and take the money off the table and put it in your pocket. Then, write a blog about how the CYC principals put their money where their mouth is, and float a $150,000 loan at a fixed rate and term I’m willing to negotiate. We can chat about the specifics from now until when I start working in July. I won’t pay a dime in origination fees, though, since I found you. I might even consult my crude compatriot for advice while we hammer out the details, if he would only stop wasting our time objectifying women on his blog.

Our back-and-forth negotiation can occupy the pages of your outstanding blog to educate your readers how to think and invest like a wealthy person, and not like a debt slave. Over the next few years, you can periodically post about our arrangement, and create a case-study on what’s possible through hard work and prudent financial decisions. In doing so, you may find yourself a collective candidate for Financial Retard of the Month and stop flogging this dead horse. You may also find MD to be an additional candidate for Man of the Year and delay honoring Wes Welker until next year. He’s further proof that hardworking people who refuse to accept mediocrity can get ahead. Is that in your book? If it isn’t, it should be.

Win-win-win. I’m including your readers here.

Another idea: Have your readers cast a vote on your options once they’re fully fleshed out if you really want to know how intelligent they are.

I’ll fully submit to the process of due diligence, and I’ll send you the pertinent information once things have been negotiated. I can even prove I completed my undergraduate studies debt-free, like our new heroes Steve Boedefeld and Zack Tolmie. Remember them*?

Then, down the road, we’ll go into business together.

I’ll find creditworthy medical students and residents and design a better risk model than most private lenders use. You source the capital, and I’ll broker the deals. I love my day job, but why not apply a little effort and put our money to work for us? If you know someone else who’s interested and would add value to the venture, let them in.

If none of these options appeal to you and your hard-earned capital is better placed elsewhere, your readers would benefit from reading your rationale.

While you evaluate the proposal from my perspective, I’ll do the same and evaluate it from yours. That’s great advice I read somewhere.

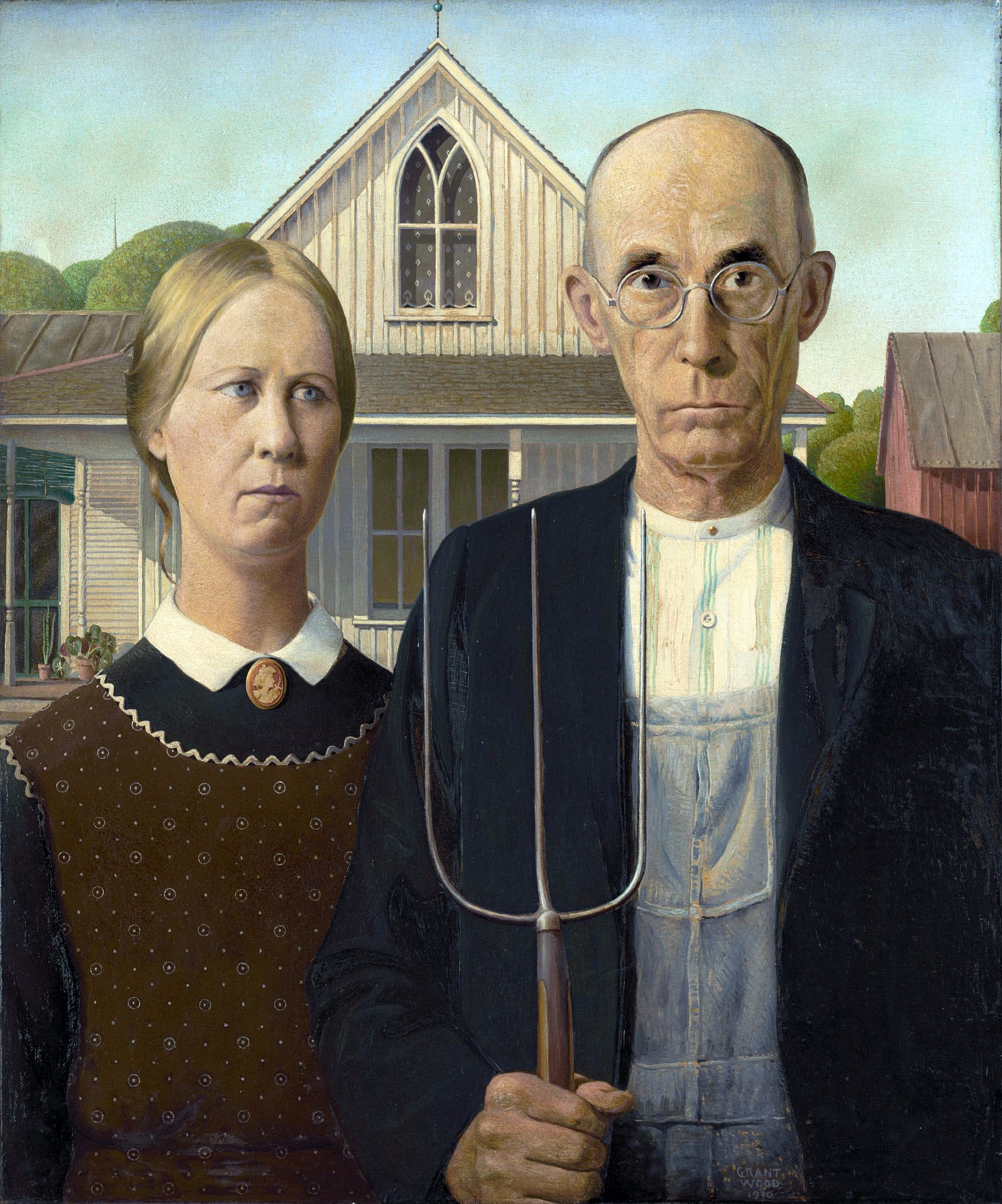

So you know I mean business, I’ve attached a picture of my wife and me.

*I mean it. These guys are (sadly) modern-day heroes.